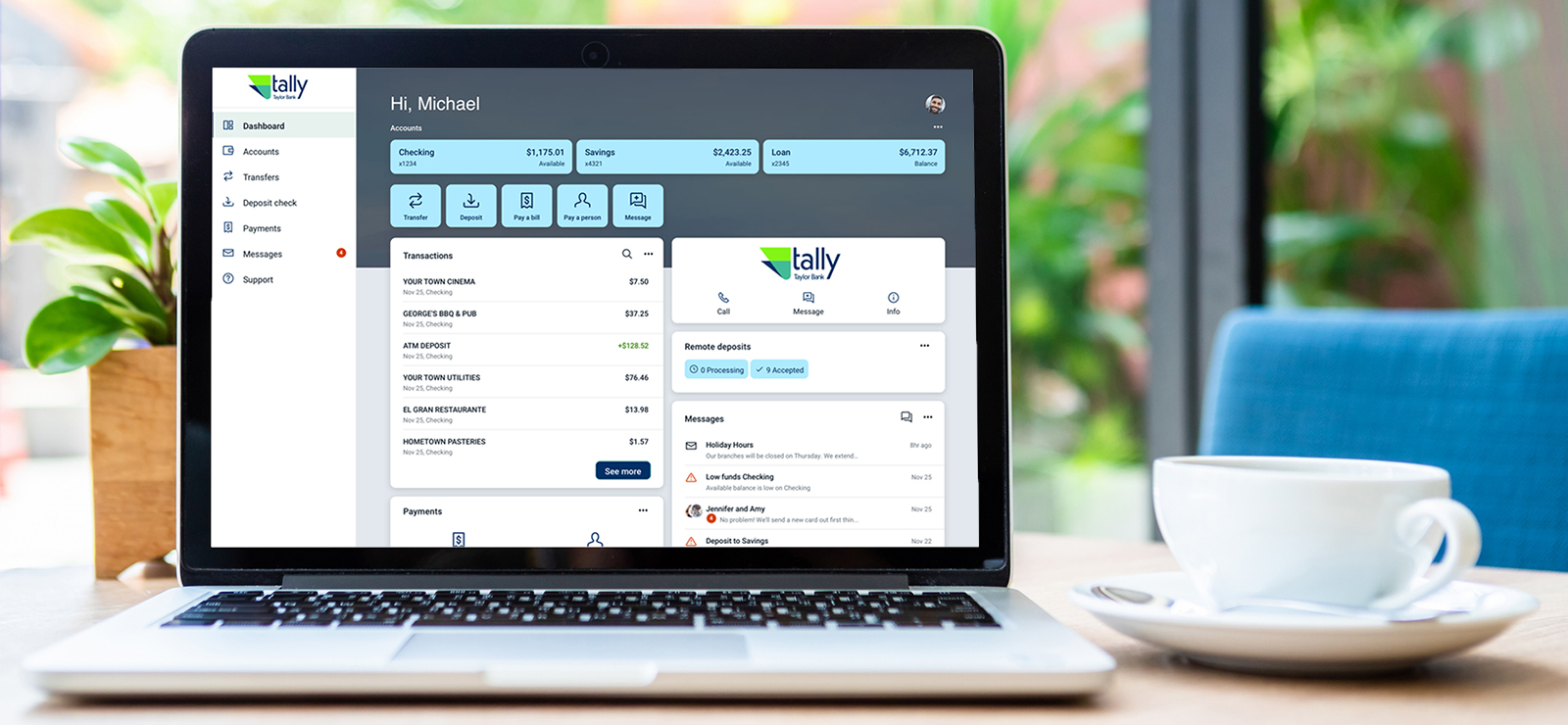

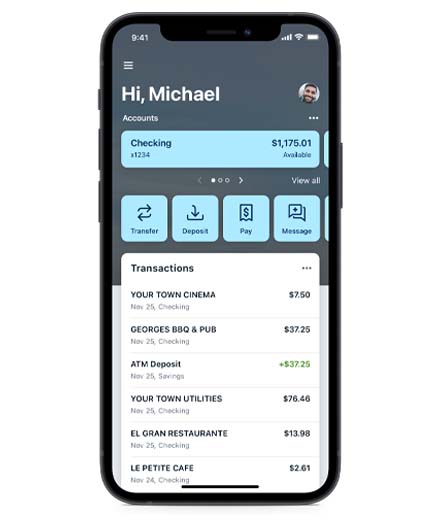

Get ready for a whole new way to bank on April 19th! Introducing Tally by Taylor Bank - a faster, simpler, more convenient way to keep tabs on your money.

At Taylor Bank, we strive to ensure an exceptional customer experience is delivered across every banking channel. With a steady increase in the use of our digital banking tools, it is our commitment to ensure we continue to develop and evolve this channel to better serve you. We’re excited to provide you with Tally, our new and improved digital banking experience, featuring:

- Simplicity: A modern, easy-to-use interface that's seamless across all your devices

- Control: Drag and drop home screen customization. You decide what accounts you see, how they are named, and in what order they appear

- Security: Enhanced security controls, helping keep you safe

- Convenience: Simple clicks to move money, pay people, send us secure messages, and more!

All of your favorite features will remain, plus exciting enhancements will be available:

Near Real-Time Transaction Alerts

Receive near real-time alerts delivered to your mobile device for additional security

Safeguard Your Account

Two-factor authentication delivers a code to you outside of the system to verify your identity at login

Control Your Debit Card

Turn your card on and off if it’s lost, stolen or being misused. Get instant alerts when your card is used. Set dollar limits to keep spending in check. Prevent transactions that don’t match your settings.

Personalize Your Experience

Upload a profile photo, add a nickname, and arrange your dashboard in the way that makes the most sense to you

Organize Your Transactions

Add tags, notes, and photos of receipts and checks

Ask Your Questions

Chat with Taylor Bank Support Specialists securely in real-time during business hours*

*Coming shortly post launch

Here's what you need to know before our upgrade:

- The new system will be live on April 19th at approximately 9am.

- Username & Password: Your username and password for online and mobile banking will stay the same. You'll need to log in with this information before you can use features like Touch ID or Face ID. If you don't remember your login credentials, give us a call.

- New Taylor Bank App: When your upgrade is ready to go, our mobile banking app will automatically ask you to download the new version.

- Browser Compatibility: Ensure you have a compatible browser downloaded on your computer. Our new online banking platform is supported by most browsers: Google Chrome, Microsoft Edge, Firefox, or Safari. It is NOT supported by Microsoft Explorer.

- Read below for further information regarding this upgrade!

Frequently Asked Questions

Why did you update your online and mobile banking?

We're always evaluating our services and how we can make them easier and more convenient for our customers. We updated our online and mobile banking to provide our customers with more features, a new modern design and enhanced security.

How do I sign in to the new Digital Banking platform for the first time?

Access From Any Device

- Once our new platform has launched on April 19th, you can log in using the same blue login button found on our site home page.

- Your current credentials will still work to log in.

- You will also be asked to set up Two-Factor Authentication, to help safeguard your account. Once this information is entered, you'll choose to receive a one-time verification code by either 1) Text message to the mobile number entered, 2) Automated phone call to the phone number entered, or 3) Authy app

Access to the New Mobile App

- Once our new app is available on April 19th, you'll first need to download it from the Apple Store or Google Play Store by searching for "Taylor Bank." (If you open the existing app on your phone, it should also prompt you to download the new app.)

- Your current credentials will work but PLEASE NOTE: Biometrics will NOT work the first time you log in to the app. You will need to contact us if you do not recall them.

- You will also be asked to set up Two-Factor Authentication, to help safeguard your account. Once this information is entered, you'll choose to receive a one-time verification code by either 1) Text message to the mobile number entered, 2) Automated phone call to the phone number entered, or 3) Authy app

Will my recurring or future dated external transfers carry over?

We are not able to convert your recurring or future dated external transfers. Therefore, you will need to re-establish those transfers in the new program.

Will my alerts transfer to the new system?

Any alerts established in the previous system will not transfer to the new system. You may re-establish balance and transaction alerts in the new system beginning on April 19. When using our mobile app, you’ll need to enable notifications in order to receive alerts.

How much account history will be available to me?

120 days of account history will transfer with the conversion, and your transaction history will build with continued activity. If you require history prior to December of 2021, please download it prior to April 19. Estatements prior to 120 days will still be available for your reference in the Documents section.

Will mobile check deposit be available for immediate use?

Yes, for previously established accounts.

In the new system, new accounts for mobile check deposit will need to be approved, and will not be available for immediate use.

What accounts are included in the transaction list on my home screen?

On the home screen, the transaction list includes transactions from all of your accounts. You may view transactions from specific accounts by clicking on the account name.

I'm seeing accounts under my profile that were not viewable in the previous system. How do I turn these off?

You may have accounts connected to your profile that were suppressed from your view in the previous system. These accounts will be viewable at the time of the upgrade.

To suppress any of your accounts, click on the account you wish to suppress, select Settings, and turn off the button next to “Show in app.”

Will my Quickbooks, Quicken or Mint accounts work in the new system?

You will have to complete the disconnect/reconnect of your online banking connection to ensure that your current Quicken or Quickbooks accounts are set up with the new connection.

There could be a delay with aggregation services for up to 3-5 business day. Customers are encouraged to download a QFX/QBO file for reference in the event of an outage.

To troubleshoot common errors, visit https://quickbooks.intuit.com/learn-support/en-us

Video Tutorials

Below you'll find quick video tutorials on how to use our digital banking services.